In the ever-evolving world of cryptocurrencies, mining machines sit at the nexus of technology, finance, and innovation. These machines are more than just costly units; they are the engines driving the entire blockchain ecosystem. The profitability of mining, particularly for popular cryptocurrencies like Bitcoin, Ethereum, and Dogecoin, heavily relies on the efficiency and capabilities of these specialized machines. As the market fluctuates, understanding the dynamics of mining machines and hosting can unlock new avenues for profit.

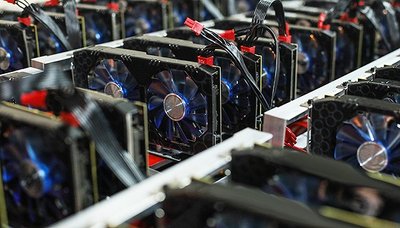

There’s more to mining than just the act of validating transactions. It’s about leveraging hardware to compete against thousands of other miners in a race for block rewards. At the heart of this battle is the mining rig, a powerhouse designed for optimizing hashing algorithms that secure networks like Bitcoin. However, with the increasing difficulty of mining and an ever-expanding list of competitors, the role of miner efficiency becomes paramount.

For prospective miners, the choice between purchasing a mining machine or considering a mining farm hosting service is often a make-or-break decision. Mining farms provide a unique opportunity to outsource the burdens of power supply, cooling, and infrastructure, allowing individuals to focus on strategy rather than logistics. Hosted mining not only cuts down on the initial investment costs but also helps in navigating the intricacies of maintaining high uptime and operational efficiency.

Bitcoin mining, with its entrenched position as the leading cryptocurrency, commands significant attention. The machines designed for Bitcoin are engineered specifically to process the SHA-256 hashing algorithm, making them essential tools for those looking to dive into this lucrative space. As more miners join the fray, the competition intensifies, leading to innovations in mining rig design and energy efficiency, setting the stage for a technological arms race in pursuit of profitability.

On the flip side, alternative cryptocurrencies like Ethereum and Dogecoin present a different mining landscape. Ethash, the algorithm behind Ethereum, requires different hardware specifications — miners need to consider memory bandwidth and GPU performance. This diversity in mining requirements across currencies means that potential investors must conduct thorough research before making a purchase. The ever-shifting nature of cryptocurrency mining not only dictates operations but also influences market trends, making it critical to stay informed about the latest developments in mining technology.

The profitability equation isn’t solely defined by computational power—factors such as electricity costs, location, and even regulatory environments come into play. Hosting facilities often provide access to lower power rates and government incentives, allowing miners to reap maximum rewards from their operations. This synergy between machine efficiency and strategic hosting choices can significantly amplify returns, especially as volatile markets pivot.

As Bitcoin leads the charge, other altcoins carve their niches, requiring miners to adapt. For example, Dogecoin’s relative ease of mining may appeal to newcomers, while seasoned miners may opt for Ethereum for its potential long-term growth. Each decision must align with a broader strategy involving timing, research, and a keen understanding of market cycles, ensuring that miners remain profitable despite the inherent risks of this digital frontier.

Currencies are constantly evolving targets in the world of mining. For instance, while Bitcoin transactions often dominate headlines, the low entry barrier to mines like Dogecoin can attract a different crowd. Depending on the chosen cryptocurrency, miners may find themselves needing to rethink their machinery, operations, and hosting arrangements to suit specific coin requirements. The sheer variety available in the crypto space makes every choice a double-edged sword—forward-thinking miners can capitalize big or run the risk of being left in the dust.

In conclusion, mastering the art of cryptocurrency mining requires more than just the acquisition of a shiny new mining rig. It involves understanding the ecosystem of hosted solutions, maintaining a strategic edge, and harnessing the power of technology to stay ahead in a competitive landscape. The potential for profitability is immense, but it necessitates a well-rounded knowledge of the intricacies of each coin, market behavior, and operational logistics. By embracing flexibility and innovation, miners can unlock unprecedented profitability in this digital age.

Leave a Reply